How do I Set Up A Scholarship Fund: A scholarship fund set-up is a financial vehicle aimed at offering educational support to students who meet certain requirements.

Understanding Scholarship Funds

Starting a scholarship fund is a powerful way to make a lasting impact—whether you’re an individual, family, business, or community group. As education costs continue to rise (with tuition up 25% in the past decade), scholarships play a vital role in keeping education accessible.

In 2024 alone, private scholarships contributed over $7.4 billion globally. As Maria Chen, founder of the Chen Family First-Generation Scholarship, shares, the process can be rewarding when approached with clear goals and the right guidance.

Types of Scholarship Funds You Can Set-Up

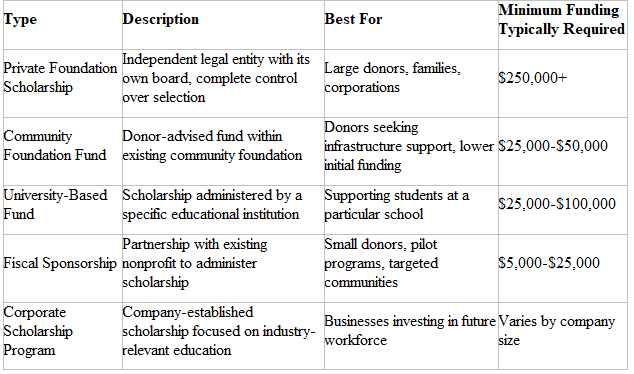

Before you dive into the setup process, it’s crucial for you to understand the various types of scholarship funds you can establish:

Guidelines to Scholarship Funds Set-up

Step 1: Define Your Scholarship’s Purpose and Vision

Start with a clear mission by answering these key questions:

- Who do you want to support? (e.g., first-gen students, STEM majors)

- Why are you creating this? (personal reasons, industry needs, community impact)

- What impact do you want? (access to education, long-term change)

- How will it stand out? (unique focus or unmet needs)

Creating Your Mission Statement:

Your mission statement should be brief (1-2 sentences) but specific enough to guide your future decisions. For instance:

Setting Measurable Goals:

- Outline specific metrics to assess the success of your scholarship:

- Number of students supported yearly

- Rates of graduation or program completion

- Impact on particular communities or areas of study

Step 2: Choose the Right Administrative Structure

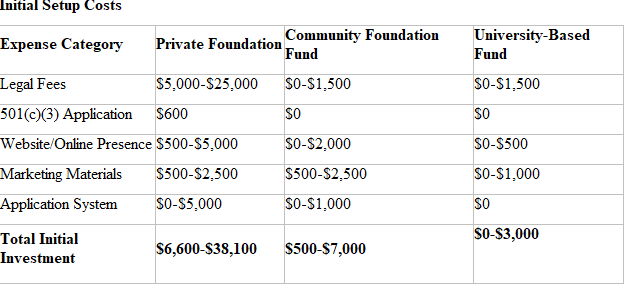

Private Foundation

Pros:

- Full control, independent operations

- Long-term family legacy

Cons:

- High setup costs ($15K–$25K)

- Ongoing admin work and 5% annual distribution required

Key Requirements:

- File 501(c)(3) with IRS (Form 1023)

- Set up board, bylaws, articles of incorporation

Community Foundation Fund

Pros:

- Immediate tax-exempt status

- Professional management, low maintenance

Cons:

- Less control

- Annual fees (1–3%)

- Must align with foundation’s mission

Setup Steps:

- Research local foundations

- Consult with staff

- Sign donor agreement

- Make first contribution

- Define selection criteria

University-Based Fund

Pros:

- Uses existing admin system

- Direct access to students

- Financial aid office support

Cons:

- Limited to one school

- Must follow university rules

- Less control over selection

Setup Steps:

- Contact advancement/development office

- Confirm minimum funding

- Create agreement

- Set funding timeline

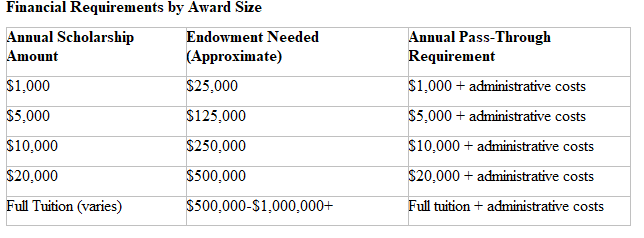

Step 3: Establish Funding and Financial Requirements

Endowed Fund

- Principal stays intact

- Pays scholarships from investment income (4–5%)

- Needs large upfront gift (usually $100K+)

- Supports scholarships long-term

Pass-Through Fund

- Scholarships paid directly from donations

- Lower upfront cost

- Requires ongoing contributions

- Ideal for short-term goals

Investment Strategies (Endowed Fund)

- Use conservative asset mix

- Hire investment professionals

- Review performance regularly

- Set 4–5% spending policy

Fundraising Approaches

- Annual donation drives

- Tribute/memorial giving

- Corporate matching gifts

- Events (galas, tournaments)

- Online crowdfunding

- Apply for foundation grants

Step 4: Eligibility & Selection

Academic Criteria

- GPA (weighted/unweighted)

- Test scores

- Enrollment status

- Class rank, major

Demographics

- Location/residency

- Financial need (FAFSA, income)

- First-gen status

- Underrepresented groups

- Military ties

Character & Achievements

- Community service

- Leadership

- Work experience

- Extracurriculars, talents

Legal Tip

- Ensure compliance with non-discrimination laws

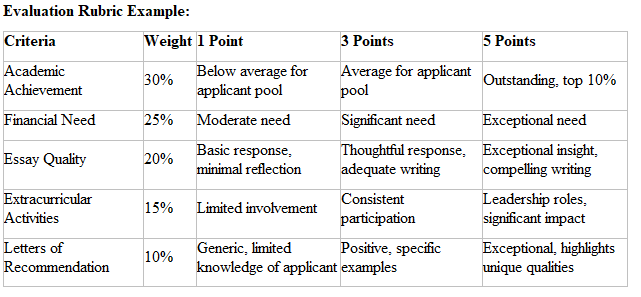

Designing an Effective Selection Process

Selection Committee Structure:

⦁ Form a committee of 3-7 members with diverse viewpoints

⦁ Implement clear conflict of interest policies

⦁ Set term limits for committee members

⦁ Provide training on objective evaluation methods

Step 5: Develop the Application Process

Application Components

Basic Info: Contact, education, demographics

Academic Docs: Transcripts, test scores, enrollment proof

Financial Info: FAFSA, income, other aid

Essays: 500–750 words, aligned with scholarship goals

Extras: Recs (1–3), resume, portfolio (if needed)

Timeline Best Practices

Start: 8–10 months before needed

Deadline: 4–6 months prior

Notification: 3–4 months ahead

Disbursement: Matches academic calendar

Sample Timeline

Oct: Open apps

Feb 1: Deadline

Mar 15: Review

Apr 1: Notify

Apr 15: Confirm

Aug/Sept: Disburse

Tech Tools

Platforms: SmarterSelect, Foundant, etc.

Forms: JotForm, Google Forms

Costs:

Free–$50/mo (basic)

$1K–$5K+/yr (platforms)

$5K–$25K+ (custom builds)

Step 6: Legal & Tax Considerations

501(c)(3) Foundation

File Form 1023, $600 fee

Takes 3–12 months

Annual Form 990-PF required

Hosted Fund (via existing 501(c)(3))

No IRS filing needed

Immediate tax-exempt status

Host charges admin fee

Key Documents

Private: Articles, bylaws, conflict policy, procedures, grant template, board minutes

Community Fund: Fund agreement, criteria doc, committee guidelines

Tax Notes

Donors:

Donations usually tax-deductible

Docs needed for $250+ gifts

Special rules for donor-advised funds

Recipients:

Tax-free if for qualified expenses

Report $600+ used for non-tuition (1099)

Reminder: Always consult a nonprofit tax/legal pro

Step 7: Launch & Promote Your Scholarship Fund

Targeted Outreach

High School:

School counselors, prep programs, youth orgs (e.g., YMCA), social media

College Students:

Financial aid offices, academic departments, student clubs, career centers

Grad Students:

Departments, associations, industry journals, research centers, conferences

Where to List

Major Platforms: Fastweb, Scholarships.com, BigFuture, MyScholarHQ, Chegg

Niche Platforms: Community foundations, identity-based orgs, professional associations

Launch Timeline

3–6 Months Before:

Finalize materials, create web presence, prep social media

1–3 Months Before:

Partner outreach, database listing, press release prep

Launch Period:

Host webinars, promote online, monitor and respond to applicants

Step 8: Manage & Sustain the Fund

Admin Calendar

Pre-App: Review criteria, update materials, confirm committee

Review: Process apps, meet with committee, verify, notify applicants

Award: Confirm recipients, verify enrollment, disburse funds, collect stories

Post-Award: Measure impact, report to donors, plan fundraising

Impact Tracking

Short-Term:

- of applications, applicant diversity, financial need met, academic stats

Long-Term:

Graduation/career outcomes, community impact, alumni engagement

Growth Tips

Financial:

Planned giving, endowment campaigns, corporate/alumni partnerships

Programmatic:

Expand criteria, increase awards, add mentoring/internships, alumni network

Succession Planning

Create a procedures manual

Document key processes

Train new members

Plan leadership handoffs

Consider long-term legacy

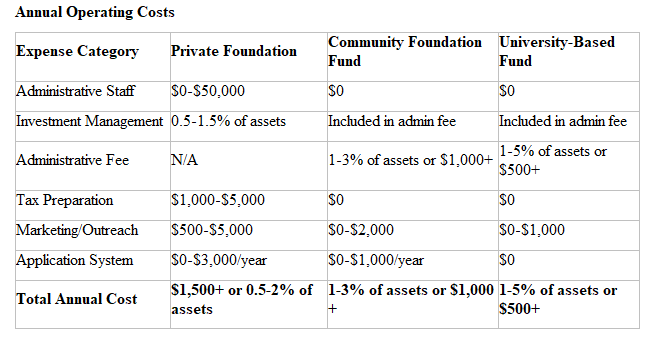

Cost Breakdown: What to Budget For

Understanding all associated costs helps ensure sustainable operations:

Real Examples: Successful Scholarship Fund Set-Up

Learning from established scholarship programs provides valuable insights:

Small Family Foundation Scholarship Fund Set-up

The Richardson Family Scholarship

⦁ Started with: $200,000 endowment

⦁ Structure: Private foundation

⦁ Focus: First-generation college students from rural areas

⦁ Awards: 4 awards of $2,500 each year

⦁ Unique Feature: Offers mentorship from family members and previous recipients

⦁ Growth: Increased to a $350,000 endowment after 12 years

Key Lesson: “Starting small but with a clear focus allowed us to make a meaningful difference in a specific community rather than trying to solve every educational need.” — James Richardson, Founder

Corporate Scholarship Fund Set-up

TechFuture Scholarship by InnovateX

⦁ Started with: $75,000 annual investment

⦁ Structure: Corporate-managed program

⦁ Focus: Underrepresented students in computer science and engineering

⦁ Awards: 15 awards of $5,000 each year

⦁ Unique Feature: Includes a paid summer internship

⦁ Impact: 78% of recipients are now working in the tech industry

Key Lesson: “Aligning our scholarship with our talent pipeline needs created a win-win for both students and our company’s long-term growth.” — Maria Valdez, InnovateX HR Director

Community Foundation Scholarship Fund Set-up

Westside Educational Opportunity Fund

⦁ Started with: $50,000 donor-advised fund

⦁ Structure: Fund at a local community foundation

⦁ Focus: Need-based scholarships for local residents

⦁ Awards: Amount varies based on need ($1,000-$5,000)

⦁ Unique Feature: Selection committee made up of community members

⦁ Growth: Now exceeds $200,000 after 7 years of community fundraising

Key Lesson: “The community foundation’s infrastructure allowed us to focus on relationship-building and student support rather than administrative details.” — Community Fund Advisory Committee

Common Challenges & Solutions in Scholarship Fund Set-Up

1. Low Application Quality

Revisit criteria for unnecessary barriers

Promote across broader channels

Simplify application steps

Provide guidance to applicants

Use alumni as ambassadors

2. Tough Choices Between Strong Applicants

Use weighted scoring rubrics

Add multi-stage selection

Include finalist interviews

Offer more or runner-up awards

3. High Admin Workload

Use scholarship software

Partner with schools/universities

Reduce renewal paperwork

Offer multi-year awards

Create a procedures manual

4. Fund Sustainability

Build an endowment

Diversify funding sources

Use matching gift options

Offer planned giving tools

Engage alumni as future donors

5. Tracking Long-Term Impact

Create an alumni database

Use follow-up surveys

Host alumni events

Build an online recipient network

Partner with schools for data

Scholarship Fund Setup Checklist

Planning

Define mission and goals

Set eligibility and award size

Choose structure and budget

Build a launch timeline

Legal & Financial Setup

Consult legal/tax pros

Pick an admin platform

File legal paperwork

Open fund accounts

Draft fund rules & strategy

Application Process

Build application form

Create evaluation rubric

Form a review committee

Write conflict-of-interest policy

Prepare recipient agreements

Set disbursement process

Marketing & Promotion

Develop scholarship branding

Launch website or online page

Design promo materials

Submit to scholarship directories

Partner for outreach

Use social media (if applicable)

Operations

Set application review process

Keep organized records

Prepare email templates

Map out yearly calendar

Define success metrics

Create reports for donors

Frequently Asked Questions (FAQs)

What’s the minimum amount to start a scholarship fund?

Community foundations: ~$25,000–$50,000

Private foundations: Often $250,000+

University-named scholarships: ~$25,000

Pass-through scholarships: As little as $1,000–$5,000/year

Can I choose the recipients myself?

No direct selection if you want tax-exempt status

Set eligibility criteria and use an independent selection committee

How long does setup take?

Community foundations: 2–4 weeks

University-based funds: 1–3 months

Private foundations: Usually longer

Can I require recipients to work for me?

Mandatory service = taxable income

Better: Offer optional internships or jobs

What portion goes to admin vs. students?

Community foundations: 1–3%

Private foundations: 5–10%

University funds: 1–5%

How do I ensure the scholarship lasts after I’m gone?

Set up an endowment

Document your wishes

Name successors or administrators

Add scholarship to your estate plan